Due to the fact Income Safety Program (PPP) was circulated, scores of small businesses provides rushed to put on hoping of finding regulators financing so you’re able to experience their organizations through the lingering pandemic . Regardless of this serious prominence, there clearly was still enough uncertainty up to PPP funds. Regarding the application and you may resource technique to cost and financing-sales, small enterprises is troubled to better see the information on the brand new Paycheck Safety Program.

A typical matter one to submit-thought small businesses ask about PPP money applies to taxation: Are my personal PPP mortgage tax-allowable?

The fresh new small response is yes, he could be! The commercial Aid Operate clarified that most business costs repaid which have PPP funds are now tax deductible. We are waiting for then Irs strategies for it to fully discover how techniques will work.

At the same time, attempt to meticulously track all of your expenses in order that you’re going to be willing to claim such write-offs in the event the big date happens. You ought to currently end up being categorizing their PPP loan expenses on the 2 kinds to receive forgiveness. This new SBA identifies her or him given that payroll will set you back and you may most other team costs.

Payroll Costs

These kinds enjoys a reputation one immediately conjures photos off paychecks, but it’s much more than just you to definitely. Acknowledged expenditures for the payroll category are:

- Compensation when it comes to wages, earnings, earnings, or similar settlement doing $100,one hundred thousand

- Fee of cash information otherwise similar

- Commission for travel, parental, friends, scientific, otherwise sick log off

- Allocation having dismissal or breakup

- Percentage away from retirement benefits

- Classification vision, dental care, impairment, otherwise life insurance

- Payment away from state or local taxation assessed on the payment off staff

According to forgiveness statutes laid out from the SBA, you must fool around with a minimum of sixty% of one’s PPP loan cash on payroll can cost you. In the event the you can find reductions on the employee wages, the quantity you can get forgiven ple, a reduction of 25% or higher during the yearly paycheck to possess personnel who generate less than $a hundred,one hundred thousand a-year will result in a smaller sized forgiveness matter.

Other Team Expenditures

Given that title of the payroll will set you back category will make they sound even more thin than it actually is, the opposite holds true for it second group. What almost every other team expenditures voice on due to the fact greater obviously, implying this category is some sort of catch-all. Nevertheless SBA has provided a list of certified expenditures, and while the guidelines tend to be of a lot helpful purposes for the cash, these kinds yes isn’t designed for what you apart from payroll.

- Medical care will set you back associated with new continuation from class health care masters throughout the attacks off sick, scientific, otherwise nearest and dearest get off, and insurance premiums.

- Financial attention payments ( not prepayment or commission of one’s mortgage dominating)

As you can see, several of the company’s doing work costs are entitled to forgiveness. Just be sure you track what you and keep maintaining the suggestions upright being submit the proper files if it is required.

Are PPP Loans Nonexempt?

Though you could allege write-offs for the expenditures funded with loan loans is an entirely various other ball game from the taxability of the loans by themselves. Therefore is a good PPP loan taxable?

PPP fund will not be taxed on a federal level, however says have selected to include this new funds because taxable money. You can examine together with your condition to see whether or not you will end up expected to shell out county fees to your financing.

Enlisting the help of Bookkeeping what is an ibv check Professionals

Given that operator, you have so many things on your own plate. You could potentially provide valued time of the assigning the bookkeeping so you’re able to an accounting service which can increase accuracy and save you money. Such as for example, Dawn also provides an online accounting tool to help you stick to top of the costs so you can guarantee you may be adhering to the brand new SBA’s expense statutes for PPP loans.

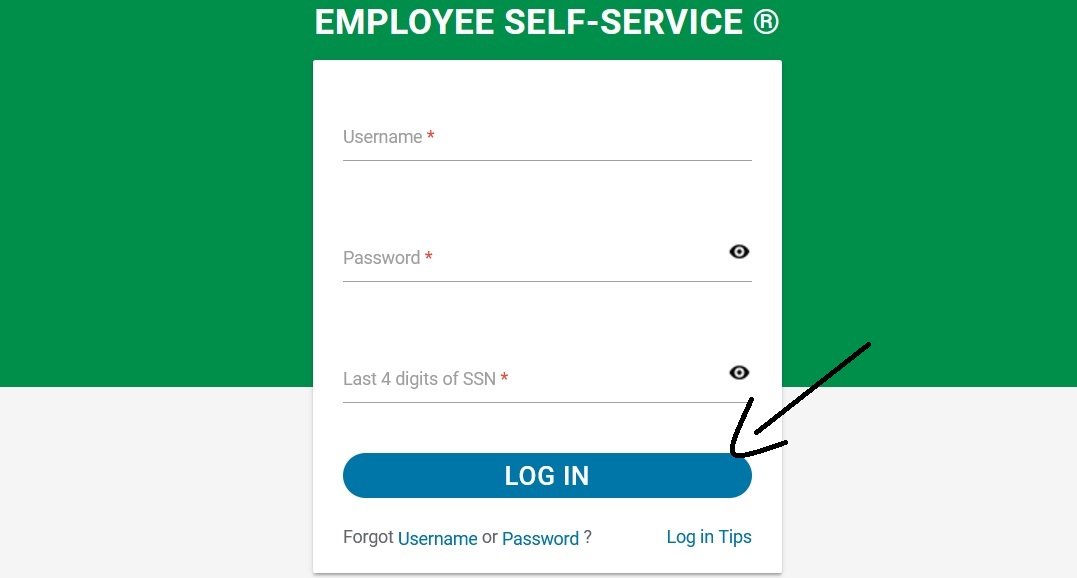

Once you have linked their playing cards and you can company checking account, your own costs and you will earnings try instantly categorized. That is right-you don’t need to help you dig through receipts and you may be concerned more the areas of your day-to-day expenses.

Income tax seasons of course will lose a number of their pain if you have bookkeeping help. You’ll end up more ready to accept your own yearly filings, as your super-arranged finances make it easier to deduct certified providers expenses paid together with your PPP mortgage. The fresh new ancillary work for is the fact your own cautious tracking will also help your efforts to discover the greatest portion of the loan forgiven.