I do the be concerned out from the home loan review techniques to possess our very own members making it simpler to get the best household loan inside Quarterly report. With over forty lenders and you will 100’s of products to pick from, choosing the right owner filled otherwise resource financing is established effortless with the software you to definitely links directly to banking institutions.

Sharing the new objectives of the financial situation for this new small and long-term, enables us to obtain a definite picture of your circumstances so you’re able to lose charges and you may fees and you will lenders financial insurance coverage (LMI) will set you back.

Within our totally free solution, we’re going to give you a full home loan testing from inside the Quarterly report discussing an educated mortgage pricing and you can evaluation costs. Providence cash advance up to $500 We are able to plus specify the actual repayments having fun with an installment calculator and take into account any extra money and final amount borrowed if using an offset membership.

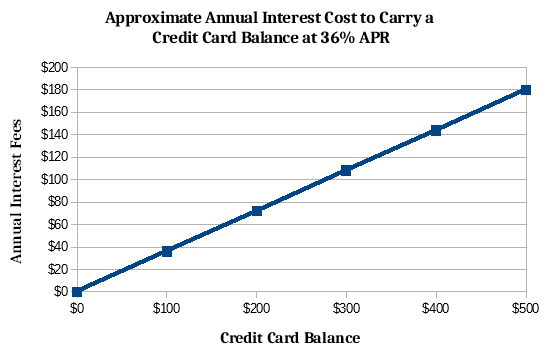

When assessing the borrowing from the bank capability and loan amount, we will describe the lender exercises your ability to repay the loan if you opt to implement, of course required, indicates exactly how playing cards and their limits increases otherwise drop off your borrowing from the bank capacity.

Best home loan cost

You can assume that an informed financial rates are definitely the of those for the lowest interest rate, but that is not always possible. In some instances, a ridiculously low-value interest go along with charges and charges and you may bank limits that produce this product much more expensiveparison cost inform you the real rate of interest but have a tendency to borrowers is actually won over of the this new claimed interest and do not cause for another issues you to definitely enhance your loan payments. Certain lenders incorporate margin to their prices of the month-to-month charges and you can costs, charge for additional money, offset levels and you will redraw establishment. We provide an entire device assessment which has every hidden charges and you can fees so you’re able to compare lenders in Quarterly report correctly.

To acquire For the Quarterly report

The brand new Sydney property business has changed notably over the last a couple of ages, especially in regions of the brand new Sydney CBD, new Northern Shore, Western Suburbs and you can North Suburbs. Getting into the fresh new Questionnaire possessions business are problematic however, truth be told there will still be ventures on the exterior suburbs off Sydney. Customers would be to prevent suburbs in which there clearly was an oversupply away from apartments due to the fact lenders examine these to be high-risk, such by big 4 finance companies. High-chance suburbs might need places as much as 30% off borrowers, so it is important to consult a quarterly report mortgage broker in advance of carrying out your residence look. Given Sydney’s highest assets values, obtaining reduced loan payments and you may including additional features such as for example a keen counterbalance account otherwise redraw business are very important to make sure you reduce costs and fees and in addition, lower the loan as soon as possible.

Home loan CALCULATOR

Probably one of the most perplexing elements of protecting home financing was workouts how much you can borrow and exactly what the mortgage money was. As a result of this a general on line home loan calculator will give home buyers completely wrong numbers and just why working with a different financial agent within the Questionnaire is vital to delivering right suggestions. When figuring your borrowing from the bank capacity and you may loan repayments, i make sure you have the ability to pay-off the loan and you usually do not extend your own borrowings beyond your costs.

Mortgage Device Testing

Knowing just how much you could potentially borrow, the next step is examine home loans to get the best home loan cost. That have access to over forty various other loan providers and 100’s various home loans, Mint Equity’s system pulls studies straight from lenders to make certain we get the fresh home loan services investigations costs to own you to select out-of.