What is actually cross-collaterisation?

Cross-collateralisation involves using one or more property given that safety to have a home loan as opposed to the antique you to property to own you to mortgage.

To put it simply, your as the a trader are looking to buy a unique assets without needing many savings, rather tapping into your home equity. The bank otherwise lender may then explore one another functions because guarantee to have an alternate home loan.

Because of the growth of this new Australian possessions business nowadays, taking advantage of a boost in family equity can be tempting so you’re able to investors using get across-collaterisation, yet , the crucial that you weigh up loads of issues just before signing a separate mortgage offer.

online installment loans Alabama

How does get across-collateralisation functions?

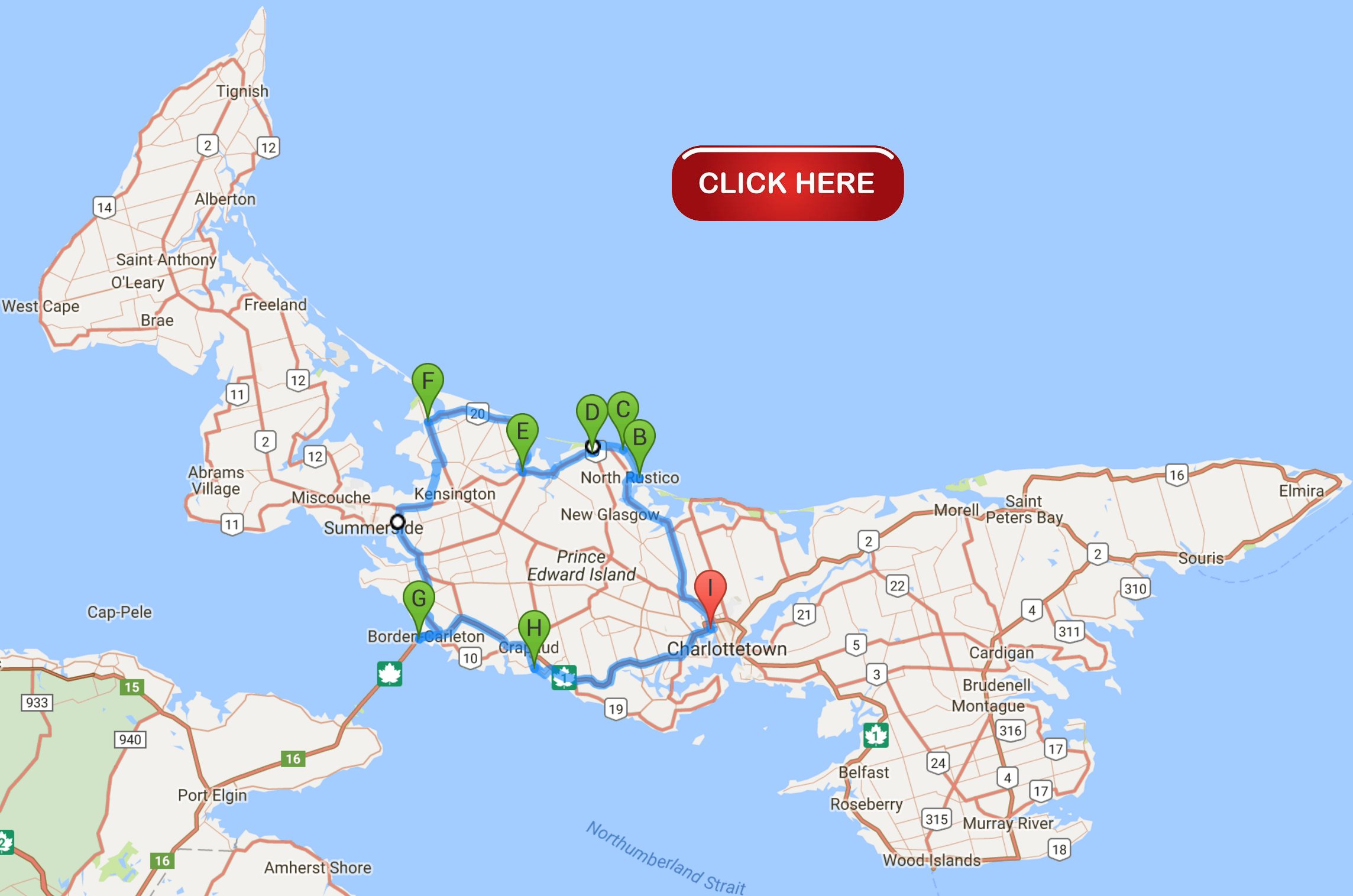

Such as what if your home is really worth $800,000 and you can you’ve reduced their home loan, hence you have $800,000 during the guarantee. You have decided we need to get good $400,000 investment property nevertheless don’t have the cash to have a beneficial 20% deposit. You check out a lender and inquire to use your own family because the safeguards to own a good $eight hundred,00 mortgage buying the fresh new $400,000 money spent. In the event the accepted, this is why this 1 mortgage try safeguarded because of the a few attributes well worth a combined $step 1.2 mil, putting the lending company really secure position that have financing-to-value proportion (LVR) away from %.

Benefits and drawbacks away from mix-collateralisation?

- Tax benefits: You will be in a position to allege tax deductions on your investment properties as a result of mix-collaterisation. When you’re playing with guarantee to order a special property, the newest re is the potential for your purchase to-be entirely tax-deductible, yet it is important to consult monetary and you can taxation experts to know exactly how tax professionals is present.

- Unlocks collateral keeping coupons in your back pocket: Unlocking the newest equity of your home allows you to miss the processes off preserving up for another deposit and you may affords you the ease off rapidly seizing an investment chance and you will strengthening a property portfolio. Cross-collateralisation can make it simpler to create, and additionally accessing security having employment including home improvements.

- Convenience: As you’re able to just mix-collateralise that have one to bank, all your money have you to definitely place with the same standard bank. This will build your profile simpler to manage, in the place of which have multiple funds across more loan providers. Having one to financial can also spend less on specific charge.

- Potentially down interest levels: Cross-collateralisation will provide a loan provider even more stamina and you will power over an excellent borrower’s assets collection when you find yourself reducing their risk coverage. As a result, lenders could be more inclined to provide a lower life expectancy notice rates toward a mix-collateralised mortgage, which could save you many along side longevity of the mortgage.

- Financial and lenders placed in the vehicle operators chair: Cross-collateralisation get always be an appealing substitute for an investor, including having family prices carried on to help you rise, but really it places banks in a stronger status as it will bring all of them with greater command over the brand new features offered they are used given that cover.

- Highest valuation will set you back: Because of the way characteristics was connected less than cross-collateralisation, for each and every property has to be expertly-respected anytime there clearly was a substantial change to the collection otherwise the mortgage, in addition to anytime a property is paid for or ended up selling. This is very time-consuming and pricey, since that have a property skillfully cherished could cost multiple hundred or so cash when.

- Point off marketing situations: If you choose to promote a corner-collateralised property, you’re in substance altering the agreement you may have along with your financial otherwise financial. Simply because youre modifying the safety the lending company keeps and possibly altering the loan-to-really worth proportion. In such a case, your financial should complete a partial launch on your financing, in which they would get rid of the property you are selling out of your financing, and you can revalue their most other possessions that may will still be on mortgage. Keep in mind there’s absolutely no make certain the house remaining with your financing tend to only qualify of this financing (we.age. LVR standards) plus financial need one to re-finance otherwise sell new other property inside high items.

Factors to consider in advance of get across collateralising

It is popular having assets traders so you’re able to diversify its profile which have house money across numerous loan providers given on one bank or bank can also be potentially set all energy solely in their hand. An easy method with this is always to pull out separate funds having for every single the new possessions into the deposit and you will costs via an enthusiastic dependent line of credit otherwise counterbalance account.

Cross-collateralisation may be a good idea so you can score a better owner-occupied rate and steer clear of having to dip in the individual coupons to acquire an investment property. That being said, it is critical to meticulously weigh up advantages and you can downsides given that to what is the best for your current financial position also to believe trying to financial suggestions to simply help dictate the mortgage construction one to serves your position.

Seeking to seize a single day and construct your assets profile? Make sure you below are a few the listing of buyer mortgage brokers to simply help their increase your residence horizons.