*This site is for educational intentions, with no court value. The results revealed right here is taken into account only as a simulation.

Desk out-of Content material

- In regards to the loan simulator

- Utilizing the borrowed funds simulator?

- What exactly is that loan?

- What is that loan having?

- Exactly what are the benefits and drawbacks off financing?

- Loan analogy

What exactly is financing?

Financing ‘s the identity accustomed designate a price provided from one individual a special to get paid off posteriorly. Naturally, our company is speaking of financial lending, where what’s lent was currency, however, financing try a general identity and certainly will be taken for a great many other one thing, an illustration would be a neighbor lends good speedycashloan.net small payday loans screwdriver to another neighbor hoping to discover it shortly after have fun with.

The fresh new mortgage can be produced from one individual a unique, but it is usual that it is created from good lender so you’re able to just one otherwise legal organization. Since the financing will never be paid down immediately, typically the most popular loan percentage experience the fresh new commission within the installments so the popular is that interest is actually energized into the latest commission regarding the loan.

What is actually a loan getting?

The borrowed funds can be used for some things, a call, settling a financial obligation, buying things, that’s, it does not have a certain goal. But there’s a form of financing that have mission, resource, it offers a precise purpose once the resource off property where there is certainly a contract to mortgage the cash especially for you to goal.

Exactly what are the mortgage designs?

The sorts of money offered get change from country to country, specific particularities could be present in certain nations and never during the most other regions. But we are able to number specific very common kind of money, see the all of them:

Among the many great things about taking out a loan we possess the fact that it is a great way to solve an emergency because if you do not have the bucks you would like at moment, to your mortgage this might be fixed.

While we mentioned earlier, there are a few sort of money available in order to meet other demands, which are very beneficial if you’re looking so you’re able to pick property or buy an automible and don’t have the currency need at present.

But instance whatever is great, loans also provide the not-so-a part, and we also probably know of some info. That loan applied for at the a lending institution will contain interest, plus work right here and become familiar with one attention. In the event your interest is simply too large you may be purchasing even more than your acquired because that loan in the end, a suitable isto check if it’s worth it.

The more payments you determine to pay back your loan, the more desire you will have to shell out also. Keep an eye on one to!

Anything to look out for is the rules into mortgage. Find out if you will find a fine having postponing an installment to arrange your self finest. When you take out of the mortgage, read up in the almost every other charge and you can taxation that is additional into the amount you’ll have to spend.

All of these can be seen due to the fact downsides, thus look much before taking aside financing making an educated choice.

Mortgage analogy

Marina wants to take a trip abroad who rates $8, and you may repay a financial obligation together with her cousin in the amount away from $step one,, so she decided to pull out financing regarding financial in which this lady has a merchant account.

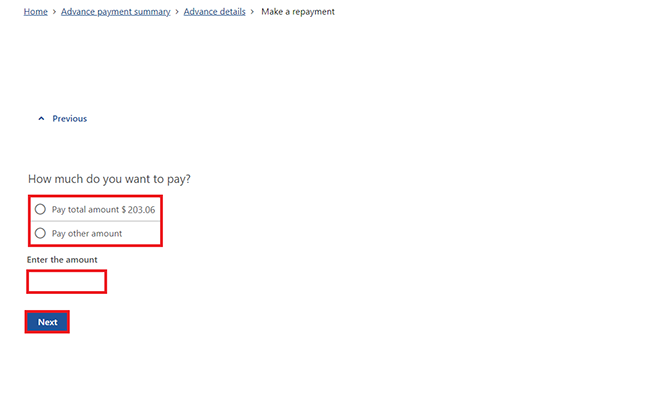

Prior to going on lender, Marina chose to create financing simulator using the financing simulation on the internet site CalculatorForUs to find an idea of simply how much she would need to pay whenever trying to get that loan when you look at the the degree of $nine,, a price that would help shell out their own sibling making your trip.

Marina watched on her behalf bank’s site your interest having a personal loan is actually 12% a year, and so she produced a simulation putting the amount of $9, at a consistent level off twelve% a-year and you may checked the payment when you look at the twelve installment payments.

The effect revealed that the fresh payments is worth $, and therefore Marina experienced higher getting their money, therefore she chose to imitate 18 installment payments.

Whilst the impact shown a slightly large total total be paid down than before, Marina enjoyed the worth of the fresh installment, which was $, whilst do easily fit into their own pouch without reducing their earnings.

Pleased with the consequence of the fresh simulator, Marina went along to their unique bank to request the loan, which had even more charge and you can fees, but was really around the simulation generated on the internet site CalculatorForUs.