To help you safer recognition to have a normal loan, its vital to demonstrated about 2 years away from stable, uniform income with the same company otherwise in exact same job.

- Income or hourly earnings

- Bonuses

- Overtime

- Fee

- Part-big date earnings

- Self-work

- Price otherwise concert functions

Loan providers manage to imagine even more sourced elements of income to have being qualified aim. For example individuals money streams eg old age money, alimony, child support, and you may Public Protection repayments. Yet not, it is important to keep in mind that for folks who receive help payments like alimony or youngster service, this type of money need to be anticipated to continue for at the least around three decades immediately after obtaining home loan.

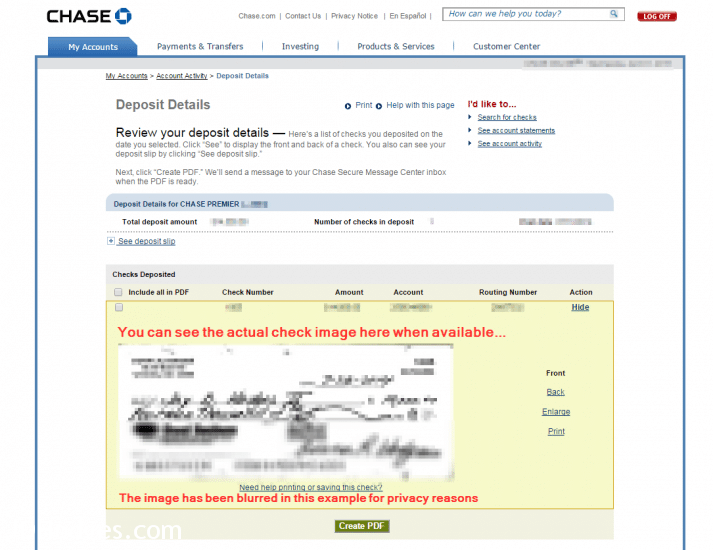

Every earnings present have to be recorded making use of your newest W-2s, taxation statements, bank comments, and you may pay stubs. Self-operating borrowers, at the same time, normally bring at the very least couple of years regarding business tax statements when you look at the addition in order to personal tax returns.

Debt-to-income proportion

When assessing their qualifications to have a mortgage, mortgage lenders check your income in comparison to current obligations financial obligation. Debt-to-money proportion (DTI) is short for brand new percentage of your own gross month-to-month money allocated into month-to-month debt payments (including the upcoming homeloan payment).

Having a traditional mortgage, loan providers favor an effective DTI proportion under thirty six %. However, DTIs around 43% can be invited. At times, you may be considered with a good DTI of up to forty-five-50%, for those who have compensating activities. These activities can sometimes include a top credit history or extreme bucks supplies held on the financial.

To help you estimate the DTI proportion, make sense the month-to-month financial obligation money and split you to sum by their monthly gross income. Like, when you yourself have a gross income away from $5,000 and you will monthly debt money off $step one,five hundred, the debt-to-money ratio try 30 %.

Loan constraints

To obtain a traditional conforming financial, the loan count need slip within this local mortgage constraints put by the the latest Government Property Loans Institution (FHFA). These loan limitations transform per year, and are generally highest inside parts which have acutely large property values. In the 2024, the fresh new compliant mortgage restrict for one-home in most of your own U.S. https://elitecashadvance.com/personal-loans-ma/ was $ , when you are high-worth financing restrictions increase to help you $ . You should check their area’s most recent loan constraints here.

If financing amounts go beyond the particular restrict, borrowers have to make an application for a non-conforming mortgage or good jumbo financing. Jumbo money generally speaking want down money varying between 10% and you can 20% off.

Assets criteria

- Single-family home otherwise multiple-tool household (no more than five systems)

- A home, perhaps not a commercial property

Concurrently, lenders keeps safeguards set up to make sure you dont borrow over our home may be worth. Once you have a signed get agreement, the mortgage lender tend to arrange for a house appraisal to verify that the revenue speed cannot go beyond new property’s genuine market value.

Old-fashioned financing conditions FAQ

Its better to qualify for a normal financing than just of a lot basic-big date homebuyers expect. You’ll need the absolute minimum credit rating away from 620 along with one or two consecutive many years of steady money and you will a career. Bringing recognized also means at least downpayment between 3 and you may 5 % and you can a debt-to-earnings ratio below 43 percent oftentimes.

In the modern home loan landscape, the idea one a 20 percent deposit becomes necessary is a myth. There are many different mortgage software, also old-fashioned funds, that offer so much more flexible downpayment possibilities. Specific first-go out homebuyers should buy with just step 3 percent down, while others will require at least 5 percent. Remember that to shop for a home that have less than 20 % down will need private mortgage insurance policies.