While against multiple mortgage and bank card rejections due towards reasonable CIBIL rating out-of 590 and wish to boost your rating so you’re able to 750, don’t worry and there is various ways to improve they. Once we talk about the CIBIL get, there is a large number of situations which go to your each other growing otherwise decreasing they. Every bank checks your credit score prior to providing you people variety of financing. A reduced get suggests that you’re not very good during the approaching your debts and also have reckless using habits. However, since you have to correct the individuals patterns today and need to construct a score out of 750, don’t worry even as we could be letting you know regarding the the the amazing a method to do the same.

Steps You ought to Remember to boost The Score

You can have a peek at a number of the beneficial tips that will make it easier to change your CIBIL score so you’re able to 750 regarding the reduced get off 590 at the moment. You will want to remain all of them planned to make certain that it can be done gradually.

Fast Expenses Payments

This is basically the firstly material you have to do to increase your credit rating. One reason why which you have an effective CIBIL get away from 590 is that you could enjoys overlooked several money. Which fundamentally happens since the handmade cards supply the solution to purchase today and you may shell out after. Due to this fact, a good amount of somebody spend beyond the fees abilities and you can fail to help make the fee on due date. Next few days, the bill goes higher on account of late fee fees, taxation or any other charge inside it. There can be odd percentage waits and defaults by way of exorbitant credit card debt. If you find yourself one up against such as for instance a problem, find the services easily else the latest rating goes then down away from 590. Make use of your discounts otherwise lower your usual spending’s to clear your the costs earliest. Up coming, you should purchase considering the repayment effectiveness and come up with the costs money on time if they is credit card bills or bills. Sure, their utility bill costs together with reflect in your credit file and you may connect with your credit score.

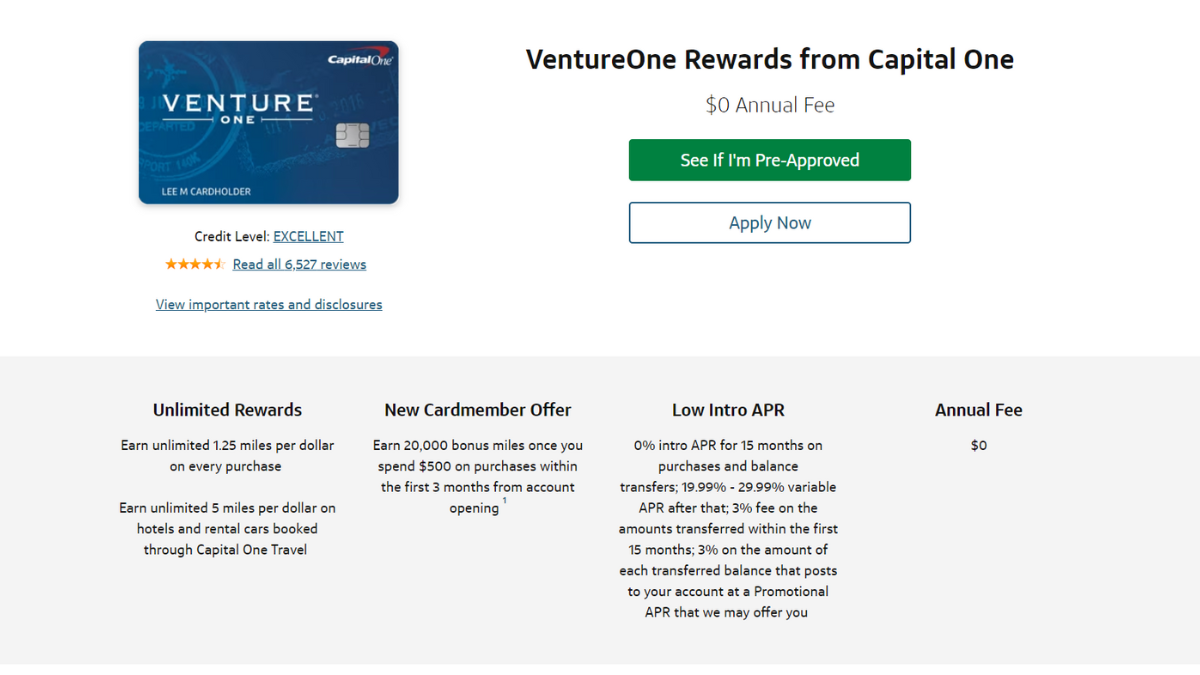

Apply Their Charge card Meticulously

When you’re an individual who thinks in review the newest constraints, the bank card is not a perfect campaign for it. When you decide to obtain increased part of your credit limit since the debt, lenders view you while the a cards eager debtor. They understand so it just like the taking debt more than what you are able pay and therefore impacts your credit score greatly. Therefore, you should make use of your charge card smartly and make use of merely 30% to 40% of borrowing limit every month. By doing this, you will also have the ability to shell out the bills on time plus credit rating have a tendency to arrived at 750 over the years.

State No’ to help you Minimum Due Percentage

Many people accept that they can log in to that have its monetary behavior by paying only their lowest owed amount to your a charge card bill. We love to share with your that it has an effect on your credit rating heavily. And with a rating regarding 590, it could be possible that you really must be performing this as well. Minimal due are the 5% of your own full statement count. When you ount, the interest or any other fees seem sensible to your left matter and you can echo within the next recharging period.

This way continuously, your ount and soon, which amount can also be so high that you will not end up being capable shell out which. For this reason, usually try to spend their overall credit card statement number, and for it, you will need to manage your purchasing designs and put an effective stop on a lot of shoppings. Expenses expenses in full and on go out was an indication of good credit behavior.

Avoid Debt settlement

If you feel your credit score should be raised to help you a rating of 750 because of installment loans in Victoria the paying down the dated debt together with your bank upcoming we want to tell you that this doesn’t happen. Through a settlement on the loans, your ount nonetheless it usually think on your credit score as the Financial obligation Settled. As a result of this, you are able to face difficulties inside the opening fresh loans. It could be better for you to eliminate almost any debt settlement together with your bank so that you can initiate afresh. You could potentially pay-all the credit card debt of the going for a consumer loan at a lower rate of interest. The reduced rate have a tendency to bring about lower monthly installments, working for you pay the money you owe on time. All that will help you improve your credit score to 750 over the years.

Check your CIBIL Declaration Regularly

Their CIBIL statement retains most of the monetary transactions made by your such as for instance mastercard money, EMI payments, utility bills although some. Sometimes, what the results are is due to certain dissimilarities on your own label , time regarding beginning, current email address id, and you may Dish, your credit score becomes impacted. Thus, it is vital to browse the report over commonly thus you could report to the financing bureau making them fix it. Incorrectness on your CIBIL report can also affect your CIBIL rating, and when you will fix her or him, your rating often raise.