iii. Loan providers you may bring a link to the latest electronic disclosures on otherwise on app for as long as users never sidestep new disclosures prior to submitting the application form.

iv. This new disclosures will be on the exact same Webpage since the the program versus fundamentally appearing with the initially display screen, immediately preceding the brand new key the individual commonly click add the application form.

In case your creditor rather sent papers disclosures for the consumer, so it requisite wouldn’t online installment loans be came across

(2) Precedence of particular disclosures. This new disclosures described during the section (d)(1) due to (4)(ii) in the point shall predate others required disclosures.

1. Precedence signal. The list of conditions provided from the creditor’s solution below (d)(4)(iii) shouldn’t have to precede another disclosures.

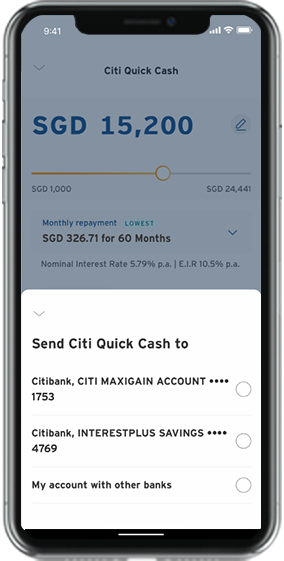

(3) Getting an application that is utilized from the user inside the electronic means, this new disclosures requisite lower than so it part can be agreed to this new user from inside the digital means to the otherwise on software.

we. below), including online during the a home computer, this new collector must provide the fresh new disclosures inside the electronic function (like with the application towards its Web site) to meet the necessity to bring disclosures during the a great timely fashion towards or to the application.

ii. Having said that, when the a buyers is really found in the new creditor’s office, and accesses a property collateral credit line app electronically, such as for instance through a terminal otherwise kiosk (or if an individual spends a terminal or kiosk situated on this new premises out-of an affiliate marketer otherwise third party having created towards the collector to incorporate programs so you can users), the collector may possibly provide disclosures in either digital otherwise papers form, offered the fresh creditor complies with the time, delivery, and retainability requirements of controls.

(b) Duration of disclosures. Brand new disclosures and you will brochure necessary for paragraphs (d) and (e) on the point can be provided at the time a software is offered on the user. The disclosures therefore the pamphlet could be lead or placed in the new post perhaps not later on than about three working days adopting the acknowledgment out of a customer’s application in the case of programs contained in journals or any other guides, otherwise if the software is gotten from the cell or because of an mediator agent otherwise broker.

1. Mail and you can cellphone programs. Should your collector delivers programs from the send, the disclosures and you can a pamphlet need compliment the application form. When the a loan application is actually bought out the phone, the fresh disclosures and you may pamphlet could be lead or shipped within three working days out-of taking the software. In the event the an application is actually sent to your individual following a phone consult, yet not, the fresh new creditor and need send the brand new disclosures and you will a brochure collectively to the application.

The web link perform do the consumer towards disclosures, nevertheless user need not be required to scroll completely by way of the disclosures; or

2. General purpose programs. This new disclosures and you will a brochure need not be provided when an excellent general-purpose application is given to a customer unless (1) the application form or materials accompanying it signify it could be familiar with make an application for property security package otherwise (2) the program emerges in reaction to a consumer’s specific inquiry about property guarantee package. Likewise, in the event the an over-all mission software program is offered as a result so you can a good buyer’s particular query no more than borrowing from the bank aside from property collateral plan, the fresh disclosures and pamphlet doesn’t have to be provided even if the software ways you can use it to possess a house equity bundle, except if it is accompanied by advertising facts about household equity arrangements.