Editorial Direction

When you take aside property security personal line of credit (HELOC), the fresh HELOC draw months is the possible opportunity to spend currency you have been recognized to help you borrow secured on your residence guarantee. Just like a charge card, you simply invest what you would like doing a set restrict and then make minimal money until the draw months ends up.

It is essential to bear in mind, although, which you cannot supply the credit range any more once the mark period is more than, and you may need to begin making larger money. Some tips about what you need to know in advance of the HELOC mark period ends up.

What is an effective HELOC draw period?

An excellent HELOC provides two levels: the new draw period while the cost months. You’re for purchasing the cash plus one is actually for expenses it straight back. That which you ultimately wish to know through to the mark period ends is when you intend to settle the financing line. Based your own personal fees strategy, there could be actions you need to through to the mark several months concludes.

What if you took away a good HELOC to cover a good do it yourself investment, such as finishing the basements; brand new draw months is the windows of energy during which you may be to find systems, color and other offers. Usually, your lender will provide you with a credit card otherwise unique inspections you should use to spend the cash. They as well as put your own credit limit, and/or limit number you might obtain, based on how much household guarantee you’ve got.

Your own mark several months was a-flat few years, usually a decade. At that time you are going to need to build lowest interest repayments, however in most cases you may not need to pay on the dominant balance. Which normally means relatively low costs that will vary based on how far you’ve lent, just like with credit cards.

At the end of the fresh new mark months, you’re in a position to replenish the credit line and restart brand new time clock. Otherwise, you are able to go into the payment several months.

How come HELOC fees functions?

Given that payment period moves, you might be not in a position to spend any longer of currency and you are clearly necessary to initiate paying back everything you lent, which have focus. Now that the changing times interesting-just costs is more than, expect the monthly payments to jump up significantly – especially if you didn’t pay down the primary equilibrium anyway throughout your draw months.

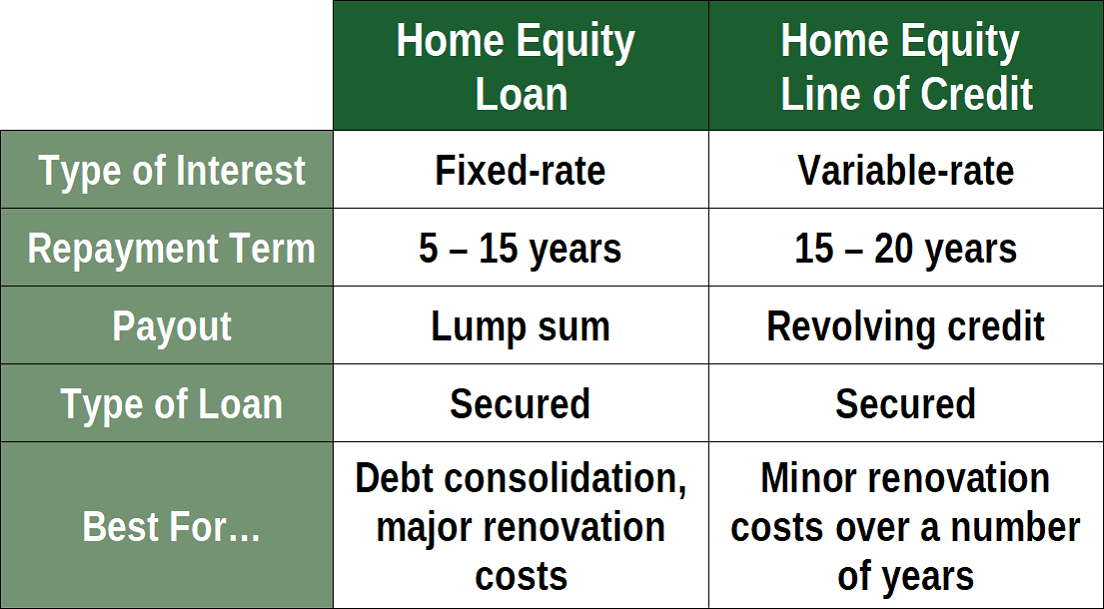

Your own repayment several months will generally become an appartment long-time, generally speaking ten so you’re able to 20. Very HELOCs features changeable interest rates, so that your payment per month may change over the course of one’s fees several months. This is exactly distinctive from a standard mortgage otherwise domestic guarantee loan, all of you quickly begin paying back that have a predetermined interest, definition your monthly obligations try not to transform.

HELOC installment example

To return to your before analogy, let’s say your basements repair is becoming long complete payday loan Selma. In total you spent $25,000 toward content, and you picked a fixed-price HELOC which have an excellent 6% rate of interest. You have as the organized 50 % of-a-dozen Awesome Pan parties from the space, however, at that time your don’t spend more the minimum (interest-only) payments. This is what your instalments perform feel like in both new mark and you can installment symptoms:

HELOC benefits choices for until the mark several months ends up

When you are taking out a HELOC, possible will often have various alternatives for expenses they right back. Check out that require you to get it done ahead of the fresh new draw several months stops.

step 1. Improve minimum payments

Its Okay to help make the minimum payments in draw several months if you are monitoring in the event that draw several months closes and you can exacltly what the payments might look like after it will. It is far from uncommon for monthly obligations so you’re able to more double once the latest installment months moves.