While you are at all like me, whenever a stack of documents is determined off facing you, you start so you can stress and you will care that you may skip things…

We have been here to walk you from the process of every one terrifying records so you can register believe!

Guaranteeing Money

The initial matter you to definitely probably crosses your head is: Exactly what rates do i need to pay for and just how much tend to focus be?

Ideally, you’d have a crude guess at heart however, verifying your income often harden these questions and provide you with a better picture. Guaranteeing just how much you make should be a fairly effortless process depending on the economic situation.

- That Paystub which paystub may be the basic paystub you can get once you score pre-acknowledged to your financing.

- The prior year’s W-dos declaration from your taxes.

Now learning one, you are sometimes thought 1 of 2 one thing: Wow! Exactly how simple! otherwise Wow! Exactly what from the my most other sourced elements of money?

Here’s the material, although some people possess income that’s straightforward and you will rapidly affirmed, particularly above, most people do not, so only be aware that you are not alone for those who need certainly to take some more procedures so you’re able to knock out that it money verification.

Independent Specialist or Thinking-Operating

Becoming notice-working otherwise an independent company are going to be super, but it does tend to make guaranteeing your income a little while trickier. Frankly, you are named a top exposure about vision out of the lending company.

The taxation aren’t removed automatically, which means you most likely owe money started tax 12 months, hence we realize actually very fun. That said, some individuals shoot for up to spending to they are obligated to pay in certain not-so-nice implies, thus unfortunately you need to establish you are not one particular anybody.

When you are becoming notice-functioning or an independent company gives you plenty of independence, we know that your salary is vary enormously year-to-12 months based on the field otherwise their mind-determination, rather than the linear income introduces in perform which have conventional businesses.

Of the a few reasons more than, the lending company are often see a home-operating people much more away from a threat than someone who is actually utilized by a company.

- couple of years out-of taxation statements in the same distinct work.

Meaning the lending company will simply imagine reported nonexempt earnings therefore cannot was in fact a great roofer one year and you can a keen accountant the 2nd.

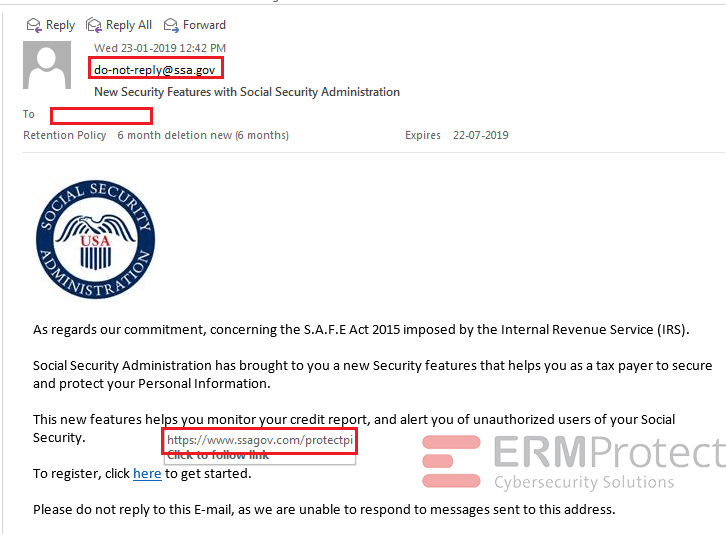

Personal Coverage and you can Disability

For those who report money off Societal Safety or Impairment, the bank will need to be sure these with their honor page which is sent out by the Societal Safeguards Management. If you need to request yet another honor page, check out this connect.

So you can complement that it, the bank may possibly request a track record of lender comments. This is particularly true getting pensions, or any other month-to-month repeated income guaranteed for what could potentially function as the duration of the loan.

Child-Help

Whenever you are revealing youngster-assistance payments within your month-to-month money, the bank should make sure a professional reputation of finding these types of costs and judge directive it came from.

Regrettably, even when child support standards are ready right up, it doesn’t suggest he could be consistently reduced, and a lender will not be able to include one to money because the reliable if you have maybe not a powerful trend off money.

Other types of money

Are just some of there’ll be other designs of cash that will be stable, predictable, and you may planning to continue. You can also become this type of earnings when trying to get your loan.

Such earnings is not very prominent for all of us getting a home loan, however if it is regular earnings, you should include it. Examples of these earnings you are going to include notice earnings, money out-of dividends, and you will whatever else this is not included in that which we currently secure.

Make an effort to reveal a history of money and therefore you will still becomes these types loans Trumbull Center of payments later on (we.elizabeth., you continue to individual this new stocks that shell out dividend).

Confirming A position

The whole process of Guaranteeing A position is mainly over from procedure off confirming earnings, however, banking companies will even will demand a file that’s called a confirmation from A position (VoE).

This is simply a type completed by your boss claiming that you will be in reality still working for the team you reported in your pre-approval app.

It does not happen that frequently but often a purchaser get dump work amongst the pre-acceptance and you may financing closure go out, this will definitely toss the borrowed funds away from sort, therefore it is crucial that you sign up for the loan during good stable and reliable period out of work, both for your own cover plus the lender’s.

Expenditures & Cost management

A lot goes into choosing what you are eligible for. Both the lending company cannot accept the full earnings number you first went inside the that have. Instance, on mind-operating, rather than a reliable a couple of-seasons record regarding tax returns, the bank may need to forget a few of the initially mentioned income. The same may also be correct with respect to over-day earnings, incentives, and you may commissions. Or if your youngster help is not consistent, they can not count it.

The bank also look at your other month-to-month expenditures for example because handmade cards, student education loans, automobile payments, also insurance coverage.

With this suggestions, however, it is vital to to apply carefully to the financial in the place of modifying something! You will never know whatever they have a tendency to ask for, take on otherwise decline, or comment on.

Trying to pay back a debt, button services, if not building the credit can adversely feeling your own assessment from the lender, therefore it is far better you need to be sincere.

This can save you from starting way too many performs, suffering a disturbing drawback, if not missing out on the family altogether.

Pre-Certification Application

We here at Braustin are certainly more than simply prepared to make it easier to submit an application and also have they sent more than become examined by the possible loan providers also answer any concerns or concerns you have got.

- Your Early in the day Year’s W2

- An excellent Paystub regarding just after your Pre-Acceptance Date

- Verification out-of A career Document

- A valid Social Protection Card

- A legitimate County-granted We.D.

- a couple of years out of Tax statements (Self-Employed Only)

Braustin Expert-Tip: Which software will and must Always be free out of charges versus significance of a deposit or earlier in the day study of their borrowing rating.

Remember, it is at some point financial institutions choice what they’re willing to financing you, so prepare yourself, truthful, collaborative, plus don’t hesitate to inquire of loads of concerns, this is your upcoming family after all!

Thanks for discovering whenever you may have any questions you would like to see answered for the web log, please drop us a note because of our Contact form or higher on Facebook. We anticipate reading from you!