Perform a good investment bundle

Getting the financing approach straight from day one to gives you the latest better opportunity during the funding success. It is essential to know very well what property and you may debts you have, such as an existing assets or any the debt. This will give you a much better comprehension of debt disease, and consequently can help you know very well what a knowledgeable capital potential try to you personally.

Simultaneously, definitely begin by wondering exactly why you need to spend money on the initial lay. What exactly do you desire to get out of they? Setting goals considering what you should get to can make yes you stay on tune since your assets expand and alter down the road.

Financial support gains otherwise rental income?

Aiming your aims can also be determine which capital approach you’re taking here. When your aim is to get to overall gains out of your resource, next centering on financing progress, or the increase in their property’s really worth over time, could be the route to take. But not, if you’re looking to suit your investment for taking the form of typical earnings, you can think about renting your property. Regular benefits from your own clients will get indicate you simply will not have to use as often ultimately causing down repayments.

Opting for an investment property

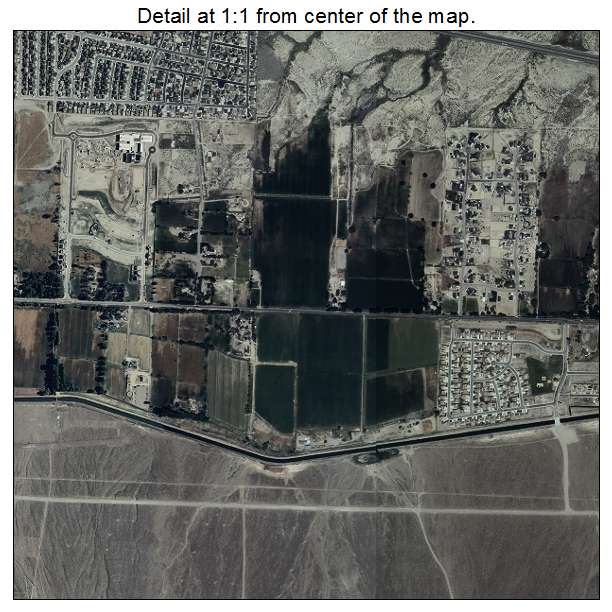

Scientific studies are key right here. Regardless of the disregard the method is, how to create your capital a survival would be to get in the right place together with correct time. And most importantly, at best rates. You need to know not only the region of the property you are considering, although relevant sector as well. ‘s the area increasing? Is the demand for local rental functions where urban area higher or lower? ‘s the populace set to boost? What are the improvements arranged that may impression forget the otherwise new desirability of your own city? These are most of the extremely important things to consider, because the every one gets an impact on the prosperity of your investment.

Finding the best money financing

It’s just as vital to discover the right financing financing just like the it is to get the right financial to you. Just like your home-based mortgage, you might choose from fixed, varying or broke up speed financing. You could make use of flexible enjoys particularly redraw and you may counterbalance membership. Very dealers prefer interest only and you will personal line of credit money, you could check with your regional lending expert to talk about the brand new financing financing alternatives that work best with your.

Trying to find tenants to fit you

If you are investing in a rental possessions, it’s also wise to look at the sort of clients you’d like. Are you searching for a household, students, an earlier few? You will want to end up being one hundred% safe having them of your property. Quite often, the sort of renter your house draws try influenced by proportions and you can area of your property, so it’s well worth having your most readily useful renters in the rear of your face as the finding your house also. The way to manage your leasing home is of the seeking a representative that knows your area really. They will be capable help you with constant handling of brand new possessions and of new tenants too. It is based just how on it we wish to enter the whole process.

When you commit to expenses, we want to have enough freedom to grow the wealth and you can take advantage of any potential that come your path. The next strategies could be useful:

- Pay back attract simply on your invested interest loan to free up your own bucks so you’re able to increase the new payments into non-deductible loans such as your residential mortgage.

- Pay back desire just given that an annual sum ahead of time to simply help your give submit your tax-deductible desire money, and so cutting your taxable earnings.

- Explore debt recycling to construct wide range by using the deals you generate in your tax otherwise money to settle your low-deductible financial obligation basic. This enables one to provide more of the equity.

Maximise your own taxation experts

When you buy a rental property, you may be eligible to deduct a variety of costs from the financing income, after that decreasing the level of taxation you pay. You happen to be entitled to deduct next expenditures:

- loan attract repayments

- human anatomy business charge

- land tax

- state and you will water rates

- yard and you will possessions repairs

- price of adverts to own tenants

Simultaneously, you could wish to envision bad gearing, and that makes reference to if the can cost you regarding running property was higher than the money you make from it. Negative gearing produces a text losses, in the sense a troubled providers can get checklist a loss towards 12 months, letting you counterbalance which loss up against the almost every other income and you can decreasing the income tax you only pay.

This new Australian Tax Work environment website provides you next page with a few more beneficial details about negative gearing, along with just what costs you’re eligible to allege.

Managing your home

Looking after your property well-looked just after and you may making certain that your tenants are content is an essential part away from managing forget the. This can be done your self, or utilize a representative to handle the home to your their part. Doing it yourself will likely be minimal, but can additionally be stressful, cutting-edge and cumbersome. Check out of the things a property manager can help you which have: